Introduction to e-Invoice Software Malaysia

In today’s fast-paced digital economy, manual invoicing simply can’t keep up. Delays, errors, and missing paperwork cost small businesses time and money. That’s where e-Invoice Software Malaysia steps in. With the Malaysian government moving toward mandatory e-invoicing for tax compliance, SMEs are now under more pressure than ever to digitize their processes.

Adopting a streamlined, secure, and regulation-ready solution like EIVY is not just smart—it’s necessary.

Benefits of e-Invoice Software Malaysia for SMEs

Small and medium-sized businesses across Malaysia are turning to e-invoice solutions to simplify operations. Here’s why:

1. Lower Operating Costs

No more printing, postage, or manual follow-ups. EIVY automates your billing and minimizes overhead expenses.

2. Faster Billing Cycles

Send invoices within minutes and receive payments quicker. With automated reminders and real-time status updates, cash flow improves almost instantly.

3. Enhanced Accuracy

Digital templates and auto-filled fields reduce common errors—no more wrong numbers, missing items, or late submissions.

4. Better Customer Experience

Professional-looking invoices and seamless delivery give clients a smoother, more trustworthy experience.

How EIVY Powers e-Invoice Software Malaysia

EIVY is at the forefront of digital invoicing in Malaysia. Tailored for SMEs, this cloud-based platform offers a comprehensive, plug-and-play solution for managing all your invoicing needs.

Made for Local Businesses

From compliance with LHDN e-invoice rules to compatibility with local tax formats, EIVY is built to support Malaysian SMEs.

Scalable and Easy to Use

Whether you’re a one-person operation or a team of 20, EIVY scales with your business. The user interface is intuitive, and most businesses are up and running within a day.

Key Features of EIVY’s e-Invoice Software Malaysia

EIVY’s all-in-one invoicing solution is packed with features that simplify financial workflows:

LHDN Compliance: All invoices generated meet Malaysian Inland Revenue Board (LHDN) standards.

Cloud Storage: Secure, accessible from anywhere.

User Roles and Permissions: Manage who sees and edits what.

Automated Reminders: Set up follow-ups for unpaid invoices.

Dashboard Analytics: Track payments, pending invoices, and customer habits.

e-Invoice Software Malaysia and Government Regulations

LHDN (Lembaga Hasil Dalam Negeri) will begin enforcing mandatory e-invoice regulations starting 2024 for businesses over a certain revenue threshold. This will eventually include all SMEs, making early adoption critical.

EIVY’s system is aligned with these policies and is updated in real-time as new guidelines are released.

e-Invoice Software Malaysia for Accounting and Finance Teams

Accounting teams in SMEs often juggle multiple responsibilities, from managing cash flow to reconciling transactions and generating reports. Implementing e-Invoice Software Malaysia—particularly a solution like EIVY—simplifies these tasks and reduces the manual workload.

Auto-Reconciliation of Transactions

With EIVY, payment data syncs directly with your invoicing records. This eliminates manual data entry errors and ensures a smooth reconciliation process between accounts receivable and payment gateways.

Clear Audit Trails

Every invoice action—creation, viewing, editing, and payment—is timestamped and recorded. These logs help ensure accountability and simplify financial audits.

Real-Time Visibility

Finance teams get instant access to the payment status of every invoice. With intuitive dashboards, tracking outstanding payments and forecasting cash flow becomes effortless.

Integration of e-Invoice Software Malaysia with ERP Systems

One of EIVY’s standout features is its robust integration capability. Whether you’re using QuickBooks, Xero, MYOB, or a local ERP system, e-Invoice Software Malaysia can connect seamlessly.

Simple API Support

EIVY offers developer-friendly APIs that facilitate fast and secure integration with your existing systems, reducing setup time and ensuring smooth data flow.

Sync Invoices Across Platforms

Invoices generated in your ERP can automatically appear in EIVY for tax filing, customer delivery, or internal approval processes—removing duplication and manual data movement.

Why SMEs Should Adopt e-Invoice Software Malaysia Now

Waiting until e-invoicing becomes mandatory is risky. By implementing e-Invoice Software Malaysia early, SMEs can:

Avoid last-minute compliance issues

Gain a competitive edge through digital readiness

Train staff gradually instead of rushing adaptation

Early adopters are already enjoying faster payments, reduced disputes, and better client relationships—reasons enough to make the switch now.

Onboarding to e-Invoice Software Malaysia with EIVY

Getting started with EIVY is a straightforward process designed with SMEs in mind.

Step 1: Account Setup

Sign up through EIVY’s website and select a pricing plan that suits your business size and volume.

Step 2: Data Import

Upload customer databases, past invoices, and product/service listings. EIVY offers templates to simplify this step.

Step 3: Customization and Branding

Add your logo, business colors, and preferred invoice format. This ensures a professional, brand-aligned look.

Step 4: Team Access and Training

Add users, assign permissions, and provide basic training through EIVY’s onboarding videos and help center.

Real-World SME Use Cases of e-Invoice Software Malaysia

EIVY’s software is already transforming businesses across industries:

Retail: Stores use EIVY to issue quick POS-linked e-invoices to customers and vendors.

Logistics: Companies automate recurring billing for subscription-based delivery services.

Professional Services: Freelancers and agencies send branded invoices and accept payments online.

Each of these businesses has reported significant improvements in processing time and payment consistency.

Customization Options in e-Invoice Software Malaysia

Not all SMEs have the same invoicing needs. That’s why EIVY provides flexibility:

Invoice Templates: Choose from multiple formats and adjust layout, fields, and currency.

Multi-Currency Support: Great for exporters and cross-border service providers.

Multi-User Access: Grant different levels of access to team members in finance, operations, and management.

e-Invoice Software Malaysia and Cybersecurity Measures

As cyber threats grow, securing financial data is non-negotiable. EIVY ensures your information is always protected.

256-bit SSL encryption keeps all data transmissions safe.

Role-based access control ensures sensitive data is only seen by authorized users.

Two-factor authentication (2FA) protects user accounts from unauthorized access.

EIVY’s cloud infrastructure is hosted on certified, secure servers with 24/7 monitoring.

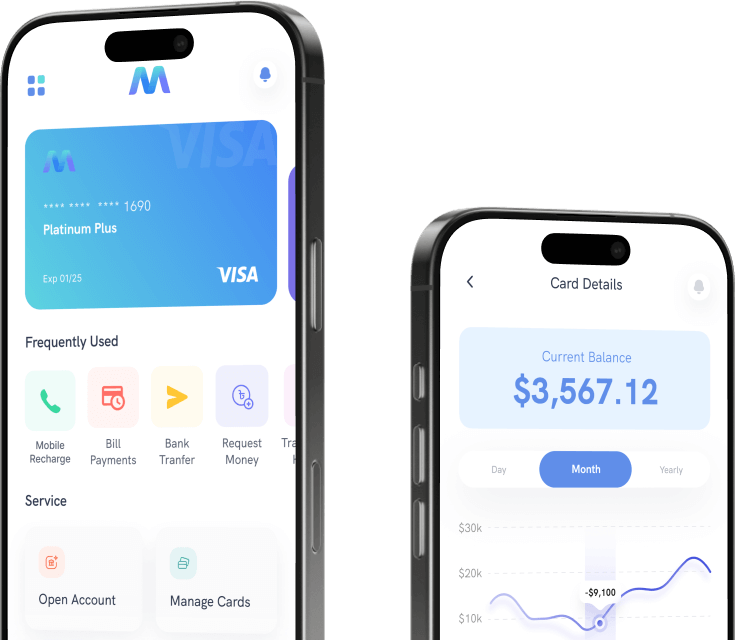

Mobile and Cloud Accessibility in e-Invoice Software Malaysia

EIVY is built for the mobile-first generation. Whether you’re in the office, working from home, or on the go, you can manage invoicing seamlessly.

Mobile App Access: Generate and send invoices directly from your phone.

Cloud Storage: All invoices are backed up in real-time, retrievable anytime.

Dashboard on-the-go: Monitor payment statuses, track overdue invoices, and view analytics in one glance.

e-Invoice Software Malaysia vs Traditional Invoicing

Let’s compare the two:

| Feature | Traditional Invoicing | EIVY – e-Invoice Software Malaysia |

|---|---|---|

| Invoice Creation | Manual (Word/PDF) | Automated with templates |

| Delivery | Email or post | Digital delivery with status track |

| Record Keeping | Paper/Local files | Cloud-based, searchable archive |

| Payment Tracking | Manual follow-ups | Auto-reminders and dashboards |

| Compliance with LHDN | Manual checks | Built-in and automated |

Common Myths About e-Invoice Software Malaysia

Let’s bust a few myths:

“It’s too expensive for small businesses.”

EIVY offers affordable plans that scale with your needs—no heavy upfront costs.“It’s difficult to use.”

The interface is designed for non-tech users. Most SMEs go live in 24–48 hours.“Only large corporations need it.”

LHDN will soon mandate e-invoices for all business sizes—SMEs included.

How to Choose the Right e-Invoice Software Malaysia

Here’s what to look for:

Local compliance readiness (like LHDN integration)

Ease of use and onboarding

Integration with your current tools

Support quality – EIVY offers responsive support via chat and email

Scalability for future growth

Final Thoughts on e-Invoice Software Malaysia

Digital transformation isn’t just a trend—it’s the future of business in Malaysia. With upcoming government mandates and rising client expectations, adopting e-Invoice Software Malaysia today sets your business up for long-term efficiency and credibility.

EIVY provides everything SMEs need: compliance, ease of use, security, and real-world functionality.

FAQs

1. Is e-Invoice Software Malaysia required by law?

It will be mandatory for most businesses by 2025 under LHDN’s digital tax transformation plans.

2. Can EIVY integrate with my current accounting software?

Yes, EIVY supports integrations with QuickBooks, Xero, SAP, and more.

3. Is e-Invoicing secure?

Absolutely. EIVY uses 256-bit SSL encryption, 2FA, and secure cloud hosting.

4. How much does EIVY cost?

Plans start affordably, with pricing tiers based on usage and features.

5. What if I need help setting up?

EIVY offers guided onboarding, live support, and training materials.

6. Can I access EIVY on mobile?

Yes, EIVY is accessible via mobile devices and tablets, perfect for remote access.