Understanding the Role of e-Invoice Software for SMEs Malaysia

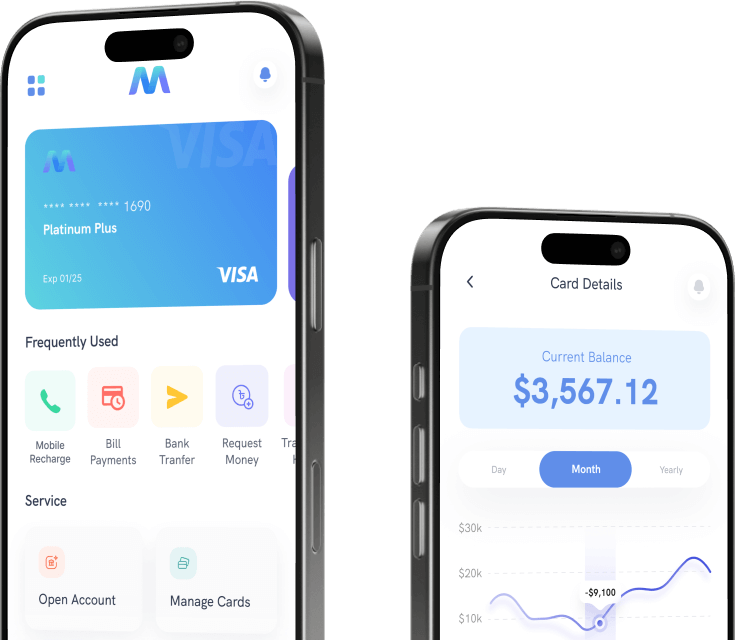

Before diving into selection criteria, it’s important to clarify what e-invoice software actually does for SMEs. At its core, this software automates the process of generating, sending, receiving, and archiving invoices electronically. This eliminates the need for manual entries, reduces errors, and supports real-time data tracking. For SMEs in Malaysia, the shift toward e-invoicing also means aligning with regulatory frameworks being introduced by LHDN (Lembaga Hasil Dalam Negeri Malaysia), which emphasizes digital audit trails and proper documentation.

Selecting the right e-Invoice Software for SMEs Malaysia involves understanding both the technical and practical sides of your business operations. Each enterprise has unique invoicing needs, which is why there’s no one-size-fits-all solution.

Key Features to Look for in e-Invoice Software for SMEs Malaysia

When evaluating e-invoice platforms, SMEs should look beyond just the price tag. Features, flexibility, and usability all play a critical role in determining whether a software solution can support your business needs today and in the future.

1. Compliance Readiness

Perhaps the most important feature for any e-Invoice Software for SMEs Malaysia is compliance with local tax laws and digital invoicing regulations. The software should be updated regularly to reflect the latest requirements from Malaysian tax authorities. Look for platforms that offer built-in templates, automated tax calculation, digital signatures, and secure archiving that meets the government’s standards.

2. Ease of Use

For many SMEs, technical know-how may be limited, and hiring a full-time IT support team may not be feasible. Therefore, ease of use is a non-negotiable. A good e-Invoice Software for SMEs Malaysia should offer a clean, intuitive interface with minimal training required. Drag-and-drop functionalities, guided invoice generation, and smart field suggestions can significantly reduce the learning curve.

3. Integration with Existing Tools

Your e-invoice software should not operate in isolation. Seamless integration with your existing accounting software, customer relationship management (CRM) systems, and inventory tools is essential. Many platforms in Malaysia offer compatibility with local and international accounting systems such as SQL, QuickBooks, or Xero. This eliminates double entry and ensures real-time synchronization.

Choosing Scalable e-Invoice Software for SMEs Malaysia

Growth is a goal for every SME. But growth also means increased complexity—more invoices, more customers, more tax reporting. That’s why scalability must be considered from the beginning.

A scalable e-Invoice Software for SMEs Malaysia should accommodate growing transaction volumes and users without performance issues. Cloud-based platforms are ideal, offering flexibility, storage expansion, and remote access. This means as your SME grows, you don’t have to switch to a new platform every few years, reducing both cost and operational disruption.

Security Considerations in e-Invoice Software for SMEs Malaysia

Security can never be an afterthought, especially when financial data is involved. Invoicing software holds sensitive information, from payment details to client records. Look for platforms that employ robust security protocols such as end-to-end encryption, two-factor authentication, and data backup systems.

Also, ensure that the provider adheres to local data protection laws. Malaysia’s Personal Data Protection Act (PDPA) sets clear guidelines on data handling and storage. An e-Invoice Software for SMEs Malaysia that offers transparent data privacy policies and complies with local regulations gives your business added protection.

Customization and Reporting Features in e-Invoice Software for SMEs Malaysia

Different SMEs operate differently. A freelance consultant has vastly different billing needs than a small-scale manufacturing firm. Therefore, customizable templates, multi-currency support, and sector-specific compliance features are critical.

Reporting capabilities are equally essential. SMEs need to monitor cash flow, outstanding invoices, tax liabilities, and sales performance. An efficient e-Invoice Software for SMEs Malaysia should allow users to generate real-time reports and export them for external audits or internal evaluations.

Evaluating Vendor Reputation for e-Invoice Software for SMEs Malaysia

While product features are essential, the reputation of the vendor providing the e-invoice software also matters. Check customer reviews, case studies, and testimonials from other Malaysian SMEs. How long has the vendor been in business? What is their track record in supporting SMEs specifically?

Reputable vendors offer not just software, but ongoing support and guidance. From implementation assistance to regular updates, a strong vendor partnership ensures your business doesn’t hit roadblocks during its digital transition.

Cost Transparency and Support for e-Invoice Software for SMEs Malaysia

Cost is always a factor for SMEs operating on tight budgets. However, the cheapest option may not always be the best. Understand the total cost of ownership—including licensing fees, implementation costs, support, and updates.

A reliable e-Invoice Software for SMEs Malaysia should come with a transparent pricing structure. Some platforms may charge per invoice, while others offer subscription models. Ensure that the pricing is aligned with your current invoicing volume and projected growth.

Also, assess the level of customer support. Is support available in Bahasa Malaysia? Do they offer live chat, phone support, or only email? Access to local support staff who understand the Malaysian business environment can make a significant difference.

Training Resources and Implementation Timeline

Transitioning to a new invoicing system takes time. For SMEs with limited manpower, this can be a strain. Choose a vendor that offers strong onboarding support, such as guided walkthroughs, webinars, and on-site training (if needed). The availability of multilingual support materials, especially in Bahasa Malaysia and English, can be especially helpful for local teams.

A typical implementation for an SME should not take longer than a few weeks if the software is cloud-based and user-friendly. However, this also depends on the complexity of your current systems and invoicing practices.

Making the Final Decision: Matching Needs with e-Invoice Software for SMEs Malaysia

When all is said and done, the best e-Invoice Software for SMEs Malaysia is the one that aligns most closely with your specific operational needs, compliance requirements, and growth objectives. Conducting a trial run, gathering team feedback, and comparing shortlisted vendors side-by-side can help make the final decision clearer.

To further explore a practical solution tailored to your business, visit this e-Invoice Software for SMEs Malaysia provider.

Conclusion

The right e-invoice software doesn’t just streamline your billing—it helps position your SME for growth, efficiency, and compliance in Malaysia’s digital economy. From ensuring legal adherence to improving workflow and reducing manual errors, the benefits are tangible. SMEs that take the time to evaluate their options carefully and match them to their long-term strategies will reap the most rewards in this digital shift.

By understanding what to look for in e-Invoice Software for SMEs Malaysia and applying a thoughtful, structured selection process, you can set your business up for smoother operations and future success.