Understanding E-Invoice SaaS Solutions in Malaysia

In recent years, the rapid advancement of technology has transformed the way businesses manage their invoicing processes. E-invoice SaaS solutions Malaysia have emerged as a pivotal tool for organizations seeking to streamline their invoicing, enhance compliance, and improve overall operational efficiency. These solutions provide businesses with cloud-based software that automates the entire invoicing process, from generation to storage, ensuring that companies can manage their accounts receivable and payable more effectively.

An e-invoice SaaS solution functions by allowing businesses to create and send invoices electronically, eliminating the need for printing and traditional mailing. This digital transition facilitates faster transaction cycles and enhances cash flow by reducing the time taken for invoices to reach clients. Furthermore, with the incorporation of features like automated reminders and real-time tracking, businesses can ensure timely payments, thereby minimizing delays and associated costs.

The significance of adopting an e-invoice SaaS solution in Malaysia cannot be overstated, particularly in today’s increasingly digital economy. With rising operational costs and tightening budgets, companies are under pressure to find cost-effective solutions. E-invoicing not only reduces these expenses by cutting down on paper usage and manual processes but also allows for better accuracy, as digital systems minimize human errors associated with manual invoicing. Additionally, compliance with regulatory requirements is a critical consideration; many e-invoice solutions are designed to ensure that businesses adhere to the Malaysian government’s invoicing regulations, thus mitigating risks associated with compliance failures.

Ease of use is another notable advantage, as these solutions typically feature user-friendly interfaces, enabling employees to adapt quickly without extensive training. Consequently, organizations can implement these systems with minimal disruption to their existing operations. Overall, e-invoice SaaS solutions represent a modern and efficient approach to invoicing that not only contributes to improved business performance but also aligns with the digital transformation strategies many companies are pursuing in Malaysia.

Assessing Your Business Size

When selecting an e-invoice SaaS solution in Malaysia, understanding the size of your business is a crucial first step. Businesses typically fall into three categories: small, medium, and large. Each category has unique needs and requirements that should be taken into account when choosing a suitable software solution.

Small businesses, often characterized by limited resources and a smaller employee base, generally seek solutions that are cost-effective and easy to use. For these enterprises, features such as automated invoicing, basic expense tracking, and user-friendly interfaces are imperative. Pricing plans that accommodate limited budgets are equally significant, leading many small businesses to select platforms offering tiered pricing based on the volume of invoices processed. The flexibility to scale as the business grows is also a consideration; a small enterprise should look for an e-invoice SaaS solution that can seamlessly adapt to its evolving needs.

Medium-sized businesses, on the other hand, require a more robust set of features to manage increasing complexities. These may include advanced reporting tools, multi-currency support, and integrations with existing accounting systems. A medium-sized enterprise is likely to benefit from an e-invoice SaaS solution in Malaysia that offers options for customization and enhanced scalability, facilitating growth without requiring a complete overhaul of systems.

Large enterprises have distinct requirements that warrant high levels of automation, regulatory compliance, and security. Their choice of e-invoicing solution frequently emphasizes features like comprehensive audit trails, real-time analytics, and API capabilities for integration with various departments. Such organizations need a solution that not only meets their current demands but also prepares them for future growth and technological advancements.

In summary, assessing business size is fundamental when choosing the right e-invoice SaaS solution in Malaysia, as it directly influences factors like features, pricing, and the overall flexibility needed for effective scaling. Understanding these aspects can aid in making a suitable decision that aligns with the business’s operational goals.

Identifying Your Industry-Specific Needs

Choosing the right e-invoice SaaS solution in Malaysia requires a comprehensive understanding of the specific needs of your industry. Different sectors face unique invoicing challenges and compliance requirements, thereby necessitating tailored functionalities in any e-invoicing system. For instance, the manufacturing sector may require the integration of procurement and inventory management alongside invoicing capabilities to streamline operations, while businesses in the retail industry might prioritize real-time sales data synchronization and advanced analytics for effective decision-making.

In sectors such as healthcare, where strict regulatory compliance is paramount, an e-invoice SaaS solution must ensure that invoicing practices adhere to local laws and standards to maintain financial integrity and transparency. Such systems need to accommodate specific documentation and reporting requirements unique to healthcare providers. Similarly, the construction industry deals with progress billing and often complex project-based invoicing, making it critical to select a solution capable of managing these complexities without compromising on accuracy and efficiency.

Furthermore, the technology industry often experiences rapid changes and the need for agile practices, which may demand seamless integration with project management tools and customer relationship management systems. Therefore, understanding these industry-specific needs will allow businesses to evaluate which e-invoice SaaS solution in Malaysia offers the features necessary to address their operational challenges effectively.

Moreover, the selection process should also consider the scalability of the solution. As businesses grow, their invoicing needs may evolve, requiring adaptable solutions that can scale with their operations. Overall, conducting a thorough assessment of your industry-specific challenges and requirements will empower you to make an informed decision when investing in an e-invoice SaaS solution tailored to your business’s unique context.

Ensuring Compliance with Regulations in E-Invoice SaaS Solutions Malaysia

Choosing an e-invoice SaaS solution in Malaysia goes beyond just functionality and user experience; it requires careful attention to compliance with local regulations. The Malaysian government has established a framework that governs electronic invoicing, which is crucial for ensuring that businesses can operate without the risk of incurring penalties or facing legal challenges.

Key legislation includes the Goods and Services Tax (GST) Act, which mandates that businesses adhere to specific invoicing standards. As such, any e-invoice SaaS solution selected must be capable of producing invoices that are compliant with the requirements of the Act, ensuring that all necessary tax information is accurately reflected. Additionally, it is essential to consider the Malaysian Accounting Standards Board (MASB) guidelines, which outline acceptable accounting practices that must be integrated into an e-invoicing system.

Furthermore, the e-invoice SaaS solution must facilitate data integrity, security, and accessibility. According to Malaysian regulations, businesses are required to retain invoices for a certain period, which demands that the chosen solution offers features such as secure cloud storage, backup capabilities, and user access controls. Solutions that do not meet these compliance requirements can expose businesses to various risks, including tax penalties and audits.

Therefore, it is critical for businesses to conduct thorough research when selecting an e-invoice SaaS solution in Malaysia. This includes verifying the vendor’s understanding of regulatory requirements and their ability to implement necessary features that align with legal standards. By prioritizing compliance in their decision-making process, organizations can mitigate risks and ensure their invoicing practices are both efficient and lawful.

Evaluating Features of E-Invoice SaaS Solutions in Malaysia

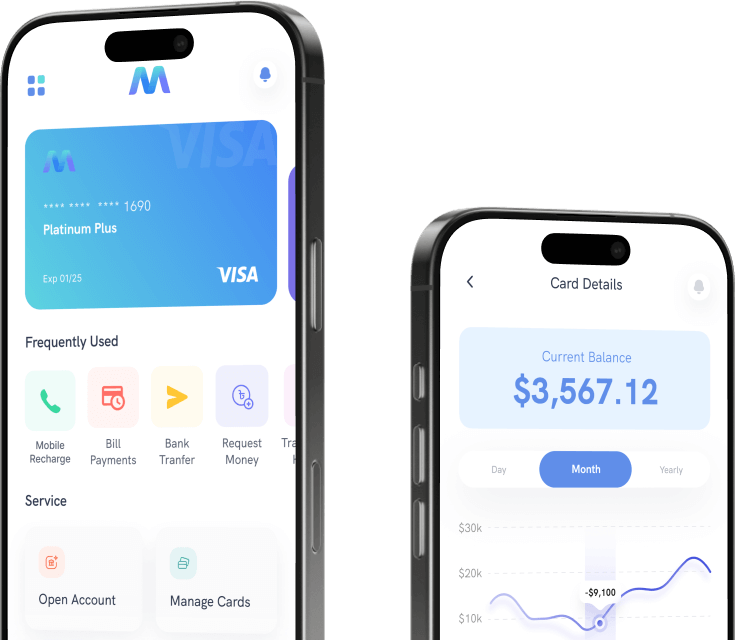

When selecting an e-invoice SaaS solution in Malaysia, businesses should carefully evaluate various features that align with their operational needs. One of the primary considerations is integration capabilities. The chosen solution should easily integrate with existing accounting software and enterprise resource planning (ERP) systems. This interoperability ensures smooth data flow and minimizes manual entry, thereby reducing errors and saving time.

Automation is another significant feature to consider. An effective e-invoice SaaS solution should facilitate automated invoice generation and distribution. This functionality not only accelerates the invoicing process but also enhances accuracy by reducing human intervention. In addition, automated reminders for overdue invoices can help improve cash flow management by ensuring timely payments.

The user interface is crucial for ease of use and adoption by staff. A well-designed, intuitive interface enhances user experience, allowing employees to navigate the system seamlessly. Training time can be significantly reduced when the software is user-friendly, facilitating a quicker transition to the new e-invoicing system.

Reporting tools are vital for businesses to analyze their invoicing and financial performance. An effective e-invoice SaaS solution in Malaysia should offer customizable reporting options, allowing businesses to track key metrics such as payment cycles and outstanding invoices, which can help inform strategic decisions regarding cash flow and financial management.

Lastly, reliable customer support cannot be overstated. A responsive support team is essential to assist users with troubleshooting and system queries. Before committing to a specific e-invoice SaaS provider, evaluate their customer support options, response times, and available support channels to ensure that assistance is readily available when needed.

Comparing Pricing Models of E-Invoice SaaS Solutions in Malaysia

When exploring e-invoice SaaS solutions in Malaysia, it is crucial for businesses to evaluate the various pricing models available. Typically, these models can be classified into three main categories: monthly subscriptions, pay-as-you-go models, and tiered pricing structures. Each pricing model presents its unique advantages and drawbacks, influencing the decision-making process.

Firstly, the monthly subscription model is prevalent among e-invoice SaaS solutions. This approach offers a fixed cost for access to the software and typically includes all features and updates. The benefit of this model is predictability in budgeting, which can be advantageous for companies with stable invoicing needs. However, should a business experience fluctuating invoice volumes, this model might result in overpayment, as they are paying for services they might not fully utilize.

On the other hand, pay-as-you-go models provide flexibility, allowing companies to pay only for the invoicing services they actually use. This can be particularly beneficial for startups or businesses that experience seasonal fluctuations in their operational needs. However, while this model can seem cost-effective, it may result in higher costs during peak periods, thus requiring careful financial forecasting.

Lastly, tiered pricing structures present a hybrid approach. This model typically offers different packages based on transaction volumes or features, allowing businesses to select a plan that aligns with their growth projections. While this can provide scalability, it may also involve hidden costs if a business unexpectedly crosses a tier threshold, resulting in an unplanned increase in expenses. Ultimately, evaluating these pricing models in detail will assist organizations in making an informed choice, ensuring that the selected e-invoice SaaS solution aligns with both their current requirements and future ambitions.

Reading Reviews and Case Studies of E-Invoice SaaS Solutions in Malaysia

When embarking on the journey to select an e-invoice SaaS solution in Malaysia, it is crucial to prioritize thorough research. Customer reviews and case studies serve as valuable resources for prospective users, providing insights into the effectiveness, reliability, and overall user experience of different solutions available in the market. Understanding the experiences of others not only aids in formulating a well-rounded perspective but also helps to identify both advantages and potential challenges associated with specific platforms.

One effective approach to gathering insights is to explore various online platforms where current users share their feedback. Websites dedicated to software reviews often allow users to rate their experiences, discuss specific features, and highlight customer service interactions. By analyzing these reviews, an individual can spot trends and recurring themes regarding the e-invoice SaaS solutions in Malaysia, such as ease of integration with existing systems, the intuitiveness of user interfaces, and support responsiveness.

Furthermore, case studies are instrumental in illustrating how a particular e-invoice SaaS solution has performed in real-world scenarios. They often showcase businesses similar to yours, detailing challenges faced, implemented solutions, and the outcomes of those implementations. Reviewing these case studies provides prospective users with concrete examples and a clearer understanding of how the software adapts to various business needs. This not only enhances the decision-making process but also builds confidence in selecting the most suitable e-invoice SaaS solution in Malaysia.

Ultimately, leveraging customer reviews and case studies lays a solid foundation for informed decision-making. It allows businesses to match their specific requirements with the capabilities of different platforms, ensuring a choice that aligns with their operational needs and strategic goals.

Trial Periods and Demos for E-Invoice SaaS Solutions in Malaysia

When selecting an e-invoice SaaS solution in Malaysia, trial periods and demos are invaluable tools that can help businesses make informed decisions. These offerings allow potential users to experience the software firsthand, evaluating its features and compatibility with their specific needs. Engaging with trial versions provides an opportunity to assess the user interface, workflow integration, and overall performance of the e-invoice solution, which is crucial for ensuring seamless financial operations.

During a trial period, businesses should focus on critical aspects that affect their invoicing processes. It is essential to test the software’s capabilities for customization, ensuring it can cater to various invoice formats and tax regulations applicable in Malaysia. Furthermore, assessing the solution’s ability to integrate with existing financial systems will contribute to a smoother transition, minimizing disruptions in the invoicing workflow. This hands-on experience enables businesses to identify any potential drawbacks or limitations before committing to a full subscription.

It is also advisable to involve different stakeholders in the trial process. By obtaining feedback from various team members who will interact with the e-invoice SaaS solution, organizations can gauge the software’s effectiveness from multiple perspectives. Their insights can highlight user-friendliness, efficiency in performing tasks, and overall satisfaction with the tool. Additionally, some providers offer guided demos that can effectively illustrate how their e-invoice system operates, which may further aid in decision-making.

Ultimately, taking full advantage of trial periods and demos will empower businesses to make a well-informed choice in selecting an e-invoice SaaS solution in Malaysia. This strategic approach not only enhances the likelihood of finding a suitable solution but also aligns with organizational goals for streamlined invoicing and improved financial management.

Making the Final Decision on E-Invoice SaaS Solutions in Malaysia

As businesses contemplate the implementation of an e-invoice SaaS solution in Malaysia, the final decision-making process becomes critical for ensuring a successful transition. To ease this journey, establishing a clear checklist can aid in evaluating the available options holistically. Firstly, operational needs should be at the forefront of your analysis. Assess your current invoicing processes and identify any gaps or inefficiencies that a new solution must address.

Next, compliance with both local and international regulations is paramount. It is essential to ensure that the e-invoice SaaS solution in Malaysia adheres to the established legal frameworks governing invoicing practices. This includes understanding tax obligations and data protection laws in order to mitigate risks associated with non-compliance.

Another vital aspect is the integration capability of the software. The chosen solution should seamlessly integrate with existing systems, such as ERP or accounting software, to foster a streamlined workflow. Consider the user experience as well, as a solution that is cumbersome or difficult to navigate may hinder employee adoption and overall effectiveness.

Additionally, evaluate the scalability and flexibility of the e-invoice SaaS solution. As your business grows, your invoicing needs may evolve, so it is prudent to choose a solution that can adapt accordingly. You may also want to explore available support and resources that come with the service. Quality customer support can significantly alleviate challenges during and after integration.

Lastly, consider the cost implications of each option. Analyzing not just the initial investment, but also ongoing costs, will provide insight into the long-term financial commitment associated with choosing a particular e-invoice solution in Malaysia. By following this checklist and aligning your decision with operational needs, compliance requirements, and strategic objectives, you can confidently select the e-invoice SaaS solution that is best suited for your business.