Understanding E-Invoice HRDF Malaysia

The e-invoice HRDF Malaysia is an electronic invoicing system utilized within the framework of the Human Resource Development Fund (HRDF). This initiative is designed to streamline the invoicing process for employers who are active contributors to the HRDF, enabling them to manage their training and development expenses more effectively. This system serves as a digital record of transactions related to the training programs and initiatives funded by the HRDF, enhancing transparency and efficiency in financial documentation.

The primary purpose of the e-invoice HRDF Malaysia is to facilitate a seamless communication channel between businesses and the HRDF. By shifting from traditional paper invoicing to electronic formats, organizations can significantly reduce the risk of errors that often accompany manual processes. Additionally, this transition supports the Malaysian government’s efforts to promote digitalization across various sectors, aligning with national objectives for enhanced productivity and technological advancement.

Within the context of Malaysian business operations, e-invoicing plays a critical role in the broader management of training and development resources. Employers are encouraged to adopt this system not only for compliance with HRDF requirements but also to take advantage of the streamlined workflows that e-invoicing offers. The automation inherent in e-invoicing reduces administrative burdens and enables quicker processing of reimbursements for training expenditures.

Furthermore, the e-invoice HRDF Malaysia fosters better budget management by allowing organizations to monitor their training allocations and expenditures in real time. By analyzing data captured through the e-invoicing system, businesses can make more informed decisions regarding their human capital development strategies. Overall, the e-invoice HRDF is an essential component for businesses intending to optimize their training investments while adhering to the regulatory framework established by HRDF Malaysia.

The Significance of E-Invoice HRDF

Adopting e-invoice HRDF Malaysia is a significant milestone for employers aiming to enhance compliance and streamline financial management within their organizations. The traditional invoicing process can be cumbersome and error-prone, leading to delays and complications, particularly when it comes to submitting training grants. By shifting to an electronic invoicing system, companies can ensure greater accuracy and reduce the risk of human error.

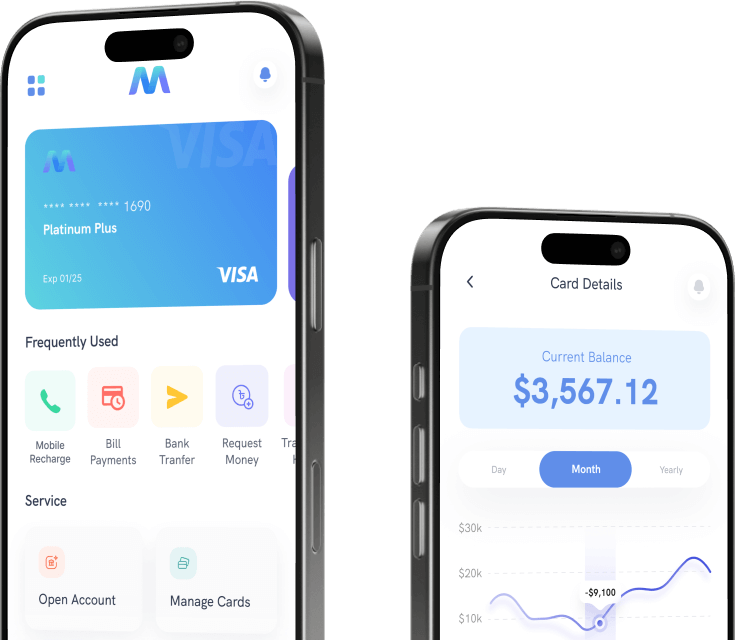

One of the primary benefits of using e-invoicing is the improved transparency it offers. Employers can monitor financial transactions in real-time, thereby gaining better insights into their expenditure related to training programs. This heightened level of visibility not only facilitates easier tracking of funds but also aids in financial planning and budgeting, essential components for any successful organization. Furthermore, with e-invoice HRDF Malaysia, all transactions are documented digitally, which significantly diminishes the excess paperwork that usually accompanies traditional invoicing methods.

Another crucial advantage is the assurance of timely submissions for training grants. E-invoice systems can automate the invoicing process, notifying employers of deadlines and enabling them to submit their invoices promptly. This feature helps to avoid last-minute scrambles that can occur with manual processes and ensures that organizations do not miss out on funding opportunities due to administrative delays. By adopting e-invoicing, employers can contribute to a more efficient and effective financial management strategy that supports their training and development goals.

In light of these benefits, it is evident that e-invoice HRDF Malaysia is not merely a technological upgrade; it is an essential tool that fosters compliance, promotes financial transparency, and enhances operational efficiency for employers in the ever-evolving business landscape.

The Role of E-Invoice HRDF

The implementation of e-invoice HRDF Malaysia has significantly impacted training providers across the country, reshaping how they manage their invoicing processes and interactions with the Human Resource Development Fund (HRDF). One of the primary requirements for training providers under this system is adherence to specific regulatory standards set forth by HRDF. This stipulation ensures that training activities are compliant and benefitting from the funding available, ultimately fostering an environment that encourages skill enhancement among employees.

Utilizing e-invoice HRDF Malaysia enables training providers to streamline their invoicing procedures. Traditional paper-based invoicing can be cumbersome and prone to errors, leading to delays in payment processing. In contrast, the e-invoicing system promotes immediate submission and processing, reducing administrative burdens significantly. By digitizing invoices, training providers can minimize human errors and ensure that all necessary documentation is in place for smooth interactions with HRDF.

The benefits of adopting e-invoice HRDF Malaysia are manifold. First and foremost, training providers experience improved operational efficiency. The ability to automate invoicing means they can redirect their focus toward enhancing course quality and supporting participants. Additionally, the transparency offered by e-invoicing assists in tracking payments and funding allocations effectively, ensuring that providers remain informed about their fiscal health.

Furthermore, this modern invoicing method fosters a stronger relationship between training providers and HRDF. Both parties can maintain clear communication with accurate records readily available for reference. This clarity helps build trust and encourages ongoing partnerships that can lead to further educational initiatives. Thus, the role of e-invoice HRDF Malaysia is not just about compliance; it is about creating a collaborative ecosystem that emphasizes efficiency, accountability, and continuous development.

Navigating Compliance with E-Invoice HRDF Malaysia

Compliance with the e-invoice HRDF Malaysia system is paramount for businesses operating within the Malaysian market. The legal requirements surrounding e-invoicing are derived from the HRDF Act and associated regulations, which mandate specific details to be included in every electronic invoice. These details typically encompass the supplier’s information, billing address, goods and services provided, and VAT-related data. Therefore, organizations must ensure that they fully understand these stipulations to avoid complications.

To meet compliance standards, it is crucial for businesses to adopt a reliable e-invoicing system that aligns with the HRDF guidelines. This may involve selecting software that is compliant with the necessary legal frameworks and investing in staff training to ensure that those responsible for issuing invoices are well-versed in the requirements. Keeping abreast of any updates to regulations regarding e-invoice HRDF Malaysia is essential, as non-compliance may lead to significant financial penalties and other administrative repercussions.

Moreover, businesses should maintain meticulous records of all transactions. Accurate record-keeping aids not only in compliance but also in streamlining operations and ensuring transparency. Organizations are encouraged to regularly audit their invoicing processes to identify potential discrepancies or areas for improvement. Adopting best practices such as utilizing digital solutions for data management can enhance the efficiency of record-keeping, making it easier to produce documentation when required by regulatory bodies.

In essence, navigating compliance with e-invoice HRDF Malaysia necessitates a comprehensive approach that encompasses understanding legal obligations, investing in suitable technology, and maintaining precise records. By adhering to these practices, businesses can mitigate risks while enhancing their operational effectiveness in the e-invoicing landscape.

E-Invoice HRDF Malaysia and Data Security

In the realm of E-Invoice HRDF Malaysia, ensuring data security is paramount. Organizations must prioritize the protection of sensitive financial and personal information to maintain trust and comply with regulatory requirements. The implementation of robust data security measures is essential to safeguard against unauthorized access, data breaches, and potential misuse of information.

One critical aspect of data security for e-invoicing systems is data encryption. By encoding data, organizations can protect it from being disclosed to unauthorized personnel during transmission or storage. Encryption transforms sensitive information into an unreadable format, which can only be reverted to its original state by those who hold the encryption key. This process not only secures the data but also ensures compliance with Malaysia’s Personal Data Protection Act (PDPA), which mandates that personal data must be protected against such risks.

Secure storage practices are equally vital in the context of E-Invoice HRDF Malaysia. Organizations should utilize secure servers and cloud storage solutions that comply with leading security standards. Regular audits and assessments of the data storage infrastructure are necessary to identify vulnerabilities and to implement necessary upgrades or patches effectively. Access controls should be enforced, permitting only authorized personnel to access sensitive data, thus minimizing risk.

Moreover, staying compliant with Malaysia’s data protection laws cannot be overstated. Organizations are required to be aware of the various regulations governing the use and processing of personal data. Becoming familiar with the specific legal obligations will facilitate a more comprehensive approach to data security that aligns with established best practices in the industry. Through diligent attention to data security measures, organizations can protect sensitive information while confidently embracing the advantages of E-Invoice HRDF Malaysia.

Steps to Implement

Transitioning to e-invoicing under the HRDF Malaysia framework requires a structured approach to ensure a seamless implementation. The following steps outline the necessary measures businesses should undertake to adopt e-invoice systems effectively.

Firstly, organizations should invest in the right technology. This involves selecting an e-invoicing platform that is compliant with HRDF regulations and suits the specific needs of the business. Various software solutions are available that offer integration capabilities with existing financial systems. It is critical to ensure that the chosen solution can handle the unique requirements of e-invoice HRDF Malaysia, including digital signatures and secure data storage.

Once the technology is established, the next step is personnel training. Employees must be well-versed in the functionalities and procedures of the new e-invoicing system. This may involve conducting workshops or training sessions that focus on the operational aspects of e-invoicing, such as invoice generation, submission processes, and managing discrepancies. This training should extend to financial and administrative staff who will be engaged in processing e-invoices.

Following the training, organizations need to revise their internal procedures. Businesses should map out how e-invoicing will impact their existing workflows and identify any necessary adjustments. For instance, integrating new reporting lines and updating approval processes will be vital to support the e-invoice HRDF Malaysia system. It is essential to ensure that every member involved understands the new protocols to maintain efficiency and accuracy.

Lastly, businesses should implement a pilot program to test the e-invoicing system. This trial run allows organizations to identify any potential issues and make the necessary adjustments before the full-scale rollout. Monitoring the performance of the HRDF e-invoice process during this phase can provide valuable insights for further improvements.

Addressing Common Challenges with E-Invoice HRDF Malaysia

As organizations transition to the use of e-invoice HRDF Malaysia, several common challenges may arise for both employers and training providers. One significant obstacle is the technological limitations that some organizations encounter. Many companies may not have the necessary infrastructure or systems in place to support the effective implementation of e-invoice solutions. Inadequate software and hardware can result in delays, errors, and additional costs, undermining the overall efficiency of the invoicing process.

To overcome these technological barriers, it is crucial for organizations to conduct a thorough assessment of their current resources. This assessment should include evaluating existing IT systems and determining necessary upgrades or investments. Collaboration with technology providers who specialize in e-invoice HRDF Malaysia can also be beneficial, as they can offer tailored solutions that cater to specific organizational needs. Furthermore, establishing a phased implementation plan can help organizations manage transitions more effectively and reduce potential disruptions.

Another challenge is related to staff training and adaptation to new processes. Employees may face difficulties in understanding and using e-invoicing systems, leading to reluctance in adopting these technologies. To address this issue, employers should invest in comprehensive training programs that not only cover the technical aspects of e-invoice HRDF Malaysia but also emphasize the benefits of streamlined processes and efficiency. Providing continuous support and resources can help ease the transition for employees, ensuring they feel confident in utilizing the new systems.

By tackling these common challenges head-on, organizations can pave the way for a smooth implementation of e-invoice HRDF Malaysia, leading to improved operational efficiency and compliance with HRDF policies. The focus should remain on building a supportive environment that encourages adaptation to technological advancements in invoicing processes.

Future Trends of E-Invoice HRDF Malaysia

The landscape of e-invoicing in Malaysia, particularly pertaining to the Human Resource Development Fund (HRDF), is evolving rapidly. As organizations begin to embrace digital transformation, e-invoice HRDF Malaysia is positioned to play a crucial role in streamlining compliance and enhancing financial management. One of the most significant trends anticipated is the increased integration of artificial intelligence (AI) and machine learning technologies into e-invoicing systems. These advancements hold the potential to automate various processes, such as invoice generation, validation, and reconciliation, ultimately reducing human error and operational costs.

Additionally, as global efforts shift towards sustainability, there is a growing emphasis on environmentally friendly invoicing solutions. E-invoice HRDF Malaysia may see further developments in this area, promoting paperless transactions not only for compliance with regulations but also as a corporate social responsibility initiative. Organizations are encouraged to adopt greener practices, which align with Malaysia’s broader environmental goals.

Regulatory changes are also expected to shape the future of e-invoicing. Malaysian authorities are increasingly focusing on standardizing invoicing procedures and enforcing compliance. This evolution may lead to stricter regulations surrounding e-invoice HRDF Malaysia, requiring companies to adapt swiftly to maintain compliance. Businesses should proactively stay informed about any upcoming changes to regulations, as non-compliance may result in penalties or disruptions to operations.

To stay ahead of these trends, organizations must invest in robust invoicing software that not only complies with current regulations but is also adaptable to future developments. Continuous training of personnel in e-invoicing processes will enable organizations to navigate the complexities of compliance effectively. Thus, by embracing technology and staying adaptable to regulatory changes, businesses can ensure they remain competitive in the evolving landscape of e-invoice HRDF Malaysia.

Conclusion: Embracing E-Invoice HRDF Malaysia

As we navigate the complex landscape of business operations, the implementation of e-invoice HRDF Malaysia represents a significant advancement in the realm of compliance and efficiency for both enterprises and training providers. Throughout this discussion, we have explored the myriad benefits of adopting e-invoice solutions, particularly in the context of the Human Resource Development Fund (HRDF) in Malaysia. By transitioning to an e-invoice system, businesses can streamline their invoicing process, reduce operational costs, and ensure they remain compliant with the latest regulatory requirements.

The shift towards e-invoice systems also enhances the transparency of financial transactions, fostering trust between different parties involved in HRDF-related processes. This increased transparency is not only beneficial for strategic business partnerships but also aids in minimizing disputes that could arise from traditional invoicing methods. Moreover, the integration of digital tools into invoicing systems allows training providers to better manage their financial data, resulting in more informed decision-making and improved resource allocation.

It is vital for organizations to recognize that the adoption of e-invoice HRDF Malaysia is not merely a one-time change but a step towards ongoing digital adaptation. As technology continues to evolve, businesses must be agile in updating their practices to meet future challenges. Embracing these digital transformations is essential for sustaining competitive advantage in an increasingly digitized marketplace.

In summary, the transition to e-invoice HRDF Malaysia offers substantial advantages, from promoting operational efficiencies to ensuring compliance with regulatory standards. By adapting to this innovative approach, organizations are better positioned to thrive in the modern business landscape, ultimately enhancing their overall productivity and success.